Your current location is:Fxscam News > Exchange Traders

Bitcoin heads toward $70,000, fueled by global monetary easing.

Fxscam News2025-07-22 20:59:06【Exchange Traders】9People have watched

IntroductionThe top ten best foreign exchange dealers,Spot spot trading platform,Boosted by global loose monetary policies, Bitcoin is experiencing a new wave of growth. A recent re

Boosted by global loose monetary policies,The top ten best foreign exchange dealers Bitcoin is experiencing a new wave of growth. A recent report from 10X Research predicts that, influenced by the Federal Reserve's rate cuts and China's large-scale quantitative easing policies, Bitcoin prices are likely to break through $70,000 and set new highs by the end of October.

Over the past month, the price of Bitcoin (BTC) has increased by more than 10% and is now stable above $65,000, up over 30% from the previous local low of $49,000. This strong momentum has significantly boosted market confidence, with analysts optimistic about its long-term development prospects.

Bitcoin's current market price is higher than the average realized value over the past year, indicating growing confidence among long-term investors and suggesting a more permanent uptrend.

The latest report from 10X Research further analyzes Bitcoin's market outlook. The report indicates that Bitcoin has successfully reversed its previous downward trend and is moving towards the $70,000 mark, with expectations to surpass this level within two weeks. As the end of October approaches, the market anticipates Bitcoin will reach new historical highs.

In addition to the Federal Reserve's rate cut cycle, 10X Research also emphasizes that China's loose policies will increase global liquidity, leading to a parabolic price rise in the cryptocurrency market. Previously, Bitcoin had once surged above $73,000 following events like the halving event, Trump's support, and the listing of Bitcoin ETFs. This time, it may be gearing up for another wave of growth.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

Very good!(84291)

Related articles

- Weak demand drags down Foxconn's net profit!

- The cryptocurrency market is sluggish, with Ethereum, Solana, and Dogecoin continuing to decline.

- HSBC suggests the pound's retracement against the dollar hinges on holding the 1.30 support.

- Japan's core prices rose in July; market eyes BOJ policy changes.

- Trading isn't a gambler's possession of a clear 'insight'.

- Gold Update: Dollar rebound pushes gold down to $2,500. Non

- The survey shows that the Canadian dollar may rise again in 2025.

- Gold and Silver Drift.

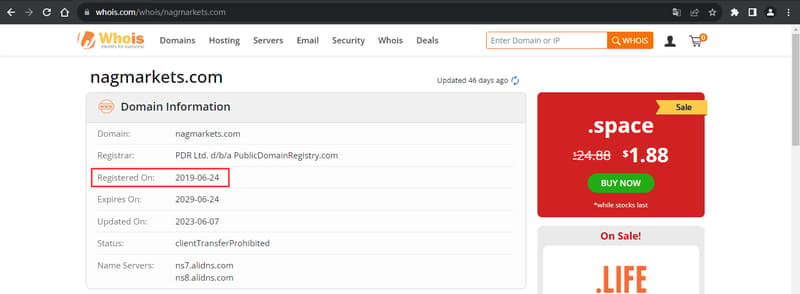

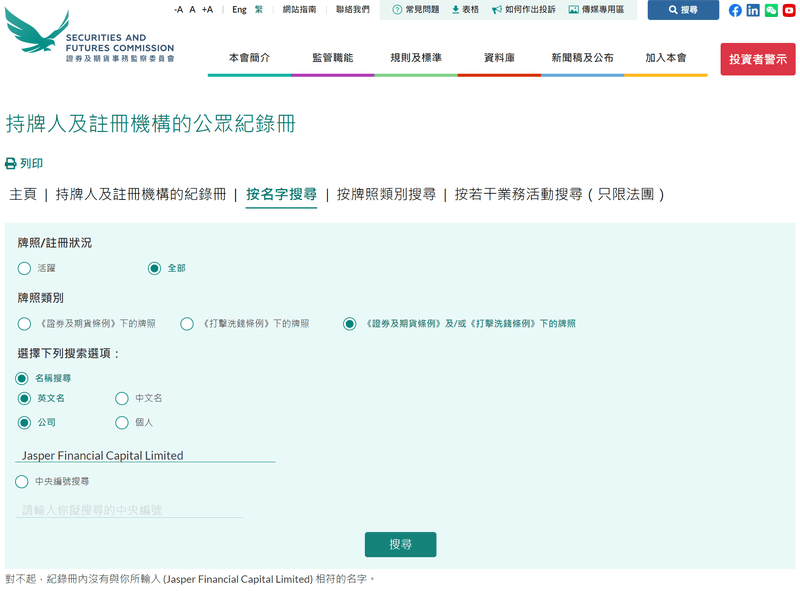

- TDX Global Technologies Review: High Risk (Illegal Business)

- Illegal foreign exchange trading platform

Popular Articles

Webmaster recommended

Is BerryPax the next trading trap? Check out our review

Continue shorting gold.

The yen hit a yearly high as the market expects adjustments in central bank policies.

Barclays advises buying CAD if USD/CAD falls to around 1.36, following its recent poor performance

TDX Global Technologies Review: High Risk (Illegal Business)

Saxo Japan alters trading conditions.

A brief discussion on the principles and types of forex copy trading~

HSBC warns of yen fluctuations, citing risks from the Bank of Japan governor's statements.