Your current location is:Fxscam News > Exchange Brokers

Should small businesses use cryptocurrency? Is it an opportunity or a risk?

Fxscam News2025-07-22 21:59:38【Exchange Brokers】8People have watched

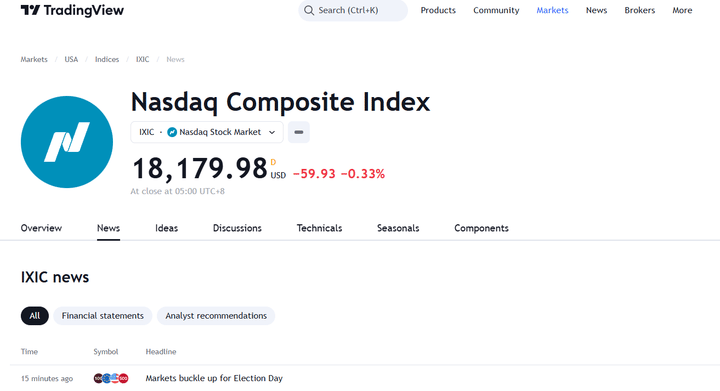

IntroductionHow to choose a foreign exchange dealer,China's current best foreign exchange platform,In today's digital age, cryptocurrencies, as an emerging method of payment and investment tool,

In today's digital age,How to choose a foreign exchange dealer cryptocurrencies, as an emerging method of payment and investment tool, are gradually attracting more and more attention. For small businesses, the question of whether to adopt cryptocurrencies has become a topic of keen interest. Although the prospects for the development of the cryptocurrency market are exciting, there are also certain risks and challenges.

The emergence of cryptocurrencies has brought a series of potential benefits to small businesses:

- The use of cryptocurrencies offers a new payment method that can attract international consumers and expand the market. By accepting cryptocurrency payments, small businesses can better meet the needs of consumers in the digital age, enhancing their competitiveness.

- The use of cryptocurrencies can reduce transaction costs, as they often do not require a third-party payment platform or bank to mediate transactions.

- Cryptocurrency transactions are secure, transparent, and irreversible, providing more trust and protection for transactions between businesses and customers.

Similarly, using cryptocurrencies also involves a series of potential risks:

- The cryptocurrency market is highly volatile, and values may fluctuate dramatically in a short period, posing challenges to the financial stability of a business.

- The uncertain legal and regulatory environment of the cryptocurrency market is also a significant issue. Because the regulatory landscape is constantly changing, it might be difficult for businesses to predict the government's stance and policies on the cryptocurrency market, increasing operational risks.

- The cryptocurrency market also faces the risk of fraudulent activities, requiring businesses to pay more attention to platform security and consumer trust.

Despite certain risks, small businesses can take measures to maximize the potential of cryptocurrencies. They can expand payment options by setting up a cryptocurrency payment option and collaborate with third-party service providers to accept cryptocurrency payments. Establishing digital wallets or creating accounts on online currency exchanges can better manage and utilize cryptocurrencies. At the same time, regular monthly employee training and security reviews are essential steps to ensure the safety and efficiency of cryptocurrency transactions.

When attempting to use cryptocurrencies, small businesses should refer to and learn from the experiences of other successful businesses. Initially, they should fully understand blockchain technology and ensure that their employees are familiar with its functions and impacts. Second, small businesses need to strengthen security measures to ensure the safety and efficiency of cryptocurrency transactions. Finally, regular reviews and updates of e-commerce platforms and integration with blockchain technology can identify and resolve potential security vulnerabilities in a timely manner.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

Very good!(315)

Related articles

- China's 2024 Bond Market Soars, 10

- Gold prices rose on weak U.S. jobs data, with focus on non

- CBOT grain prices rise due to inventory adjustments, export demand, and weather concerns.

- Gold and silver rose, COMEX gold futures up 0.71%, mining stocks gained.

- Blockrisex Exposed: A Carefully Engineered Investment Fraud

- U.S. sanctions on Russian oil push crude futures to four

- Gold futures have seen increased volatility due to a stronger US dollar and fluctuating CPI data.

- Silver may outperform gold in 2025, with spot prices expected to reach $40.

- HYHLB Group FX Broker Review: High Risk (Suspected Fraud)

- Gold surged 27% in 2024: What investment opportunities lie ahead for 2025?

Popular Articles

- US courts let SEC prosecute Coinbase, backing crypto regulation.

- Oil prices fluctuate quietly ahead of holidays, with focus on Trump's energy policy.

- The cold wave and contract expiry jointly push U.S. natural gas futures toward a critical level.

- Oil prices fluctuate as Trump's tariff news shakes markets and energy supply concerns persist.

Webmaster recommended

IFE MARKETS Broker Review: High rRsk (suspected fraud)

Grain futures volatile as funds shift and supply

Cold wave fears drive oil prices up 2% to a two

U.S. natural gas hits 52

HCapitalForex Trading Platform Review: High Risk (Scam)

Cold weather and lower inventories push oil prices up as investors eye key data.

Ample supply may pressure China's soybean meal prices before the Spring Festival.

Coke prices weaken as seasonal benefits fade and supply