Your current location is:Fxscam News > Foreign News

Trump warns Japan of possible 35% tariffs, rules out extension of “tariff deadline”

Fxscam News2025-07-22 22:10:04【Foreign News】4People have watched

IntroductionSingapore's largest foreign exchange trading platform,Which foreign exchange dealers are reliable,Trump Issues Another Tariff Warning to JapanOn Tuesday, July 1, during the U.S. stock market midday

Trump Issues Another Tariff Warning to Japan

On Tuesday,Singapore's largest foreign exchange trading platform July 1, during the U.S. stock market midday session, President Trump once again warned about Japan's tariff issues, expressing doubt about reaching an agreement with Japan before the "tariff deadline" on July 9. He suggested that Japan might need to pay tariffs of 30%, 35%, or whatever level the U.S. decides to impose.

Trump emphasized that the United States would not consider extending the current pause on imposing "reciprocal tariffs" beyond July 9, showing the U.S. government's tough stance on trade negotiations. Trump stated, "If there's no agreement, Japan must face these tariffs."

July 9 is a Crucial Date for the "Tariff Deadline"

In April, the U.S. announced the imposition of "reciprocal tariffs" on some countries but granted Japan a 90-day suspension, with a deadline of July 9. If the U.S. and Japan cannot reach an agreement on tariffs by the deadline, Japanese exports of cars and parts to the U.S. could face import tariffs as high as 35% or more.

This "tariff deadline" has become a critical point in U.S.-Japan trade negotiations and a significant risk event for the markets. Analysts highlight that the threat of high U.S. tariffs could affect Japanese exports in the automotive, machinery, and electronics industries and potentially disrupt the stability of global supply chains.

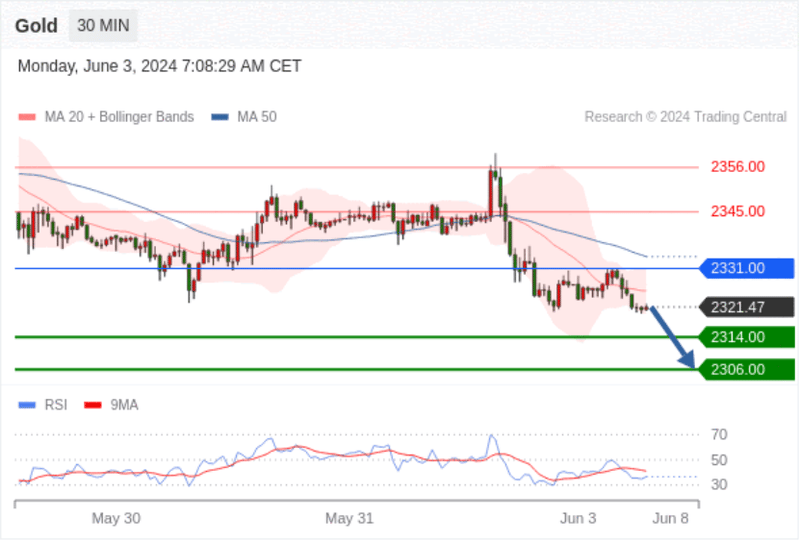

Yen Exchange Rate Maintains Strong Upward Trend

After Trump's speech, the dollar-yen exchange rate fell by 0.2% to 143.57, maintaining an intraday gain of about 0.2%. Although the yen has not yet returned to the low of 142.70 recorded during the European stock market session, it still demonstrates its safe-haven appeal amid rising trade risks.

Markets believe that increased U.S. trade threats to Japan might drive investors to buy yen for safety, adding pressure on the Bank of Japan and Japanese exporters in managing exchange rates.

Japan Faces Tariff Pressure and Economic Risks

If the U.S. imposes import tariffs of 30%-35% or higher on Japan, it could directly impact Japan's export-driven economy, particularly affecting the automobile industry and related parts supply chain. Japanese companies might be forced to reassess their market positioning and cost structures in the U.S.

Moreover, high tariffs could increase the retail prices of Japanese goods in the U.S., weakening the competitiveness of Japanese brands, further affecting domestic production and employment stability, and posing more uncertainties for Japan's economic recovery.

Outlook: Trade Negotiations Stalemate Could Cause Market Fluctuations

As the July 9 "tariff deadline" approaches, whether U.S.-Japan trade negotiations achieve a breakthrough will directly affect market sentiment and exchange rate fluctuations. If Trump insists on imposing high tariffs without a resolution, it could elevate global market risk aversion, leading to a stronger yen.

Investors will closely watch statements from Trump and the Japanese government, and the potential countermeasures they might adopt, while being wary of retaliatory measures and supply chain disruptions that high tariffs might provoke, adding more variables to global financial markets and Japan's economic trajectory.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

Very good!(43)

Previous: Capital Index Review: Regulated

Related articles

- Driss IFC is a Scam: Beware!

- Refiners anticipate that Saudi Arabia will reduce its crude oil export prices for August.

- The Reserve Bank of Australia stated that tariff remarks only mildly pressured the dollar.

- What is ring trading? It's how it works and differs from regular trading.

- EnclaveFX Broker Evaluation:High Risk(Suspected Fraud)

- Refiners anticipate that Saudi Arabia will reduce its crude oil export prices for August.

- The US Dollar Index fell as the Euro was boosted by prospects of peace in Ukraine.

- Japan's GDP growth forecast downward revised, central bank likely to maintain unchanged policy.

- Market Insights: Jan 10th, 2024

- The US dollar devaluation hits a 50

Popular Articles

Webmaster recommended

XPro Markets Broker Review:Regulated

U.S. Treasuries lose appeal as foreign investors may shift to domestic bond markets.

The Russia

OPEC and other producers pledge ongoing cuts, supporting oil prices near yearly highs.

Market Insights: Feb 26th, 2024

Katsunobu Kato emphasizes the need for dialogue and reform to stabilize the government bond market.

New Zealand dollar fluctuates as rate cut expectations rise.

The Reserve Bank of Australia faces its first consecutive rate cuts in six years.