Your current location is:Fxscam News > Exchange Dealers

SEC approves BlackRock Bitcoin option, potentially boosting the Bitcoin market.

Fxscam News2025-07-22 22:11:49【Exchange Dealers】0People have watched

IntroductionChina Financial Online Foreign Exchange Network,Foreign exchange platform query,Last Friday, the US Securities and Exchange Commission (SEC) approved BlackRock's Bitcoin Spot

Last Friday,China Financial Online Foreign Exchange Network the US Securities and Exchange Commission (SEC) approved BlackRock's Bitcoin Spot Options (IBIT), which sparked strong market reactions and bullish sentiment. The IBIT options adopt the American exercise style, allowing holders to exercise their rights at any time before the expiration date, further enhancing the product's flexibility and appeal. Although the SEC has approved this option product, it still awaits further approval from the Options Clearing Corporation (OCC) and the Commodity Futures Trading Commission (CFTC), both of which have not yet provided a specific response time.

The Bitcoin market has received significant attention in recent years. As the world's largest cryptocurrency by market value, its price volatility and market participation have made it a favored risk asset among investors. The introduction of Bitcoin ETFs and related derivatives offers institutional investors a new avenue to enter this market, increasing its liquidity. The IBIT options are seen as an important hedging and risk management tool that not only helps investors cope with Bitcoin price volatility but also effectively manage the risk exposure of Bitcoin-related positions.

Experts generally believe that the SEC's approval will have a profound impact on the Bitcoin market. Eric Balchunas, Senior ETF Analyst at Bloomberg, pointed out that the approved Bitcoin ETFs will inject more liquidity into the market, attracting more large institutional investors. Jeff Park, Head of Strategy at Bitwise Alpha, is also optimistic about this product, predicting a possible explosive growth in the Bitcoin market. He stated that BlackRock's Bitcoin options will bring enormous demand growth for Bitcoin by providing more tools to help investors enter the market, driving its price to rise rapidly.

The Bitcoin market has experienced several ups and downs in recent years, from the surge in 2017 to the new high in 2021 and the subsequent adjustments and pullbacks, indicating significant volatility. However, with more institutional funds entering and the continuous enrichment of related financial products, the market is gradually maturing. The approval of Bitcoin ETFs and options products not only provides institutional investors with more investment and hedging tools but also marks the gradual recognition of the Bitcoin market by the mainstream financial system.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

Very good!(244)

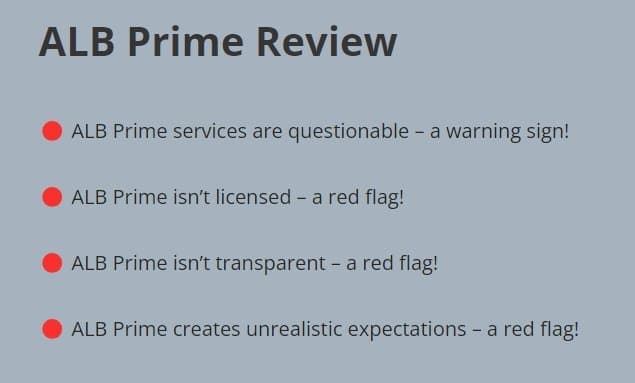

Previous: Theo Broker Review:High Risk(Suspected Fraud)

Next: 市场洞察:2024年4月2日

Related articles

- Market Insights: April 18th, 2024

- Corn rebounds strongly, wheat gains on geopolitical risks, soybeans hit a low.

- The CEO of the second

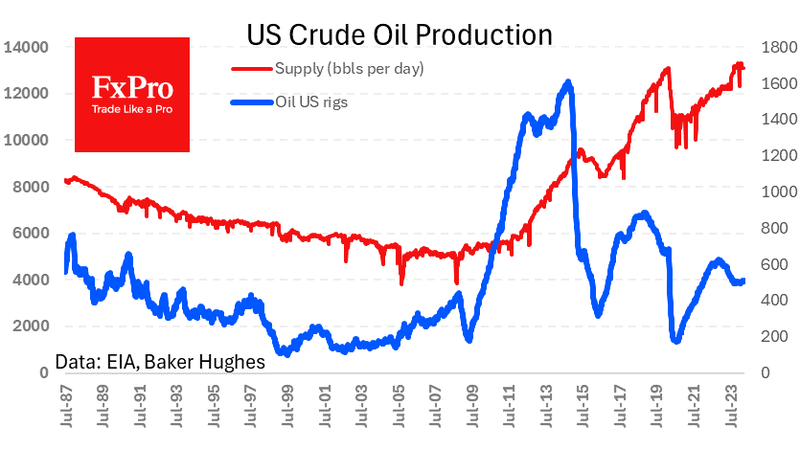

- Oil prices dropped over 7% due to geopolitical tensions and economic data.

- CySEC blacklists updated! Four illegal investment websites receive warnings.

- Grain market bullish! Soybeans gain on policy support, wheat leads CBOT futures.

- Middle East conflict worsens supply crisis, driving oil prices up for two days.

- With technical and fundamental support, silver may see a historic rebound and strong year

- How to Choose a Forex Trading Platform?

- Iron ore and copper futures rise, driven by policy incentives.

Popular Articles

- The China Consumers Association will enhance oversight of ride

- Low oil prices widen Gulf budget deficits, challenging Saudi Arabia's Vision 2030.

- The risk of a blockade in the Strait of Hormuz could cause oil prices to soar to historic highs.

- Asian stimulus policies and Middle East tensions drive crude oil prices up over 1%.

Webmaster recommended

11.06 Industry News: Cyprus company Neo Premium Investments' license has been revoked.

Dollar strength and policy uncertainty pressure global grain futures prices downward.

Analysts say gold's rebound hasn't shifted the market's momentum away from sellers.

Is the commodities bull market just starting? Reevaluate your portfolio now.

Market Insights: Feb 29th, 2024

Oil prices dropped over 7% due to geopolitical tensions and economic data.

Inventory declines and delayed OPEC+ boost oil prices, fueling U.S. crude sentiment.

Crypto leaders in the U.S. are fundraising for Harris, pushing for lenient regulation.